More money is being injected into the telehealth space in Europe. Zava, a long-time player that bills its online service as offering a “discreet and convenient” alternative to an in-person doctor visit, has just announced a $32 million Series A round, led by growth equity firm HPE Growth.

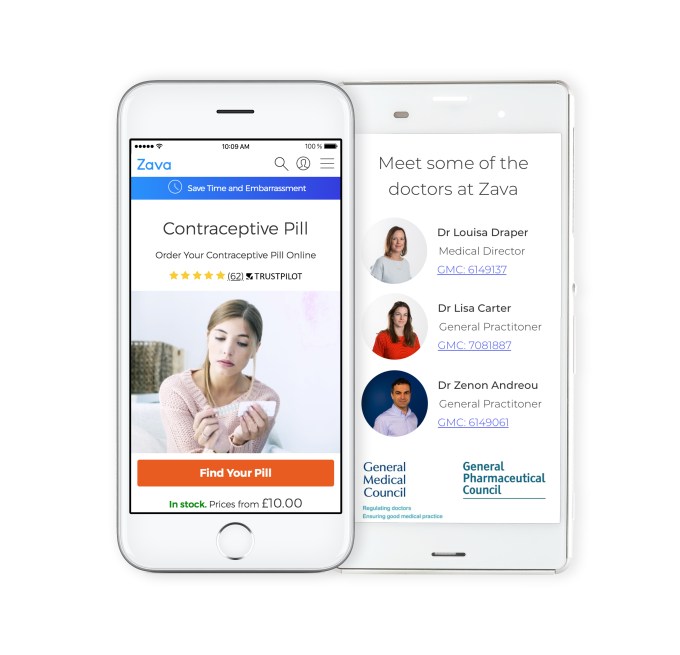

Zava relies on patients filling in an online medical questionnaire which is reviewed by a person from its team of in-house doctors/clinicians as part of the remote consultation process. Test kits and/or medicine can follow in the post or be sent to a pharmacy for the patient to collect.

“Zava provides reliable and convenient access to a qualified clinical team, via written communication, which drives an effective patient:doctor relationship,” says co-founder and CEO David Meinertz. “The questions we ask in our written questionnaire are exactly the same questions a GP would ask — but the patient can do this in their own time, meaning their answers are often more thorough.”

“Our patients feel more comfortable not having to discuss medical conditions that they might find embarrassing face to face, so we often find our patient answers are very direct,” he adds. “We’re not replacing doctors with AI and we are not just putting doctors on video. Zava is providing healthcare that enables doctors to treat patients more efficiently and more safely.”

Commenting on the Series A in a statement, Harry Dolman, partner at HPE Growth, added: “Zava offers a unique and highly scalable model to deliver a more convenient healthcare experience to patients while radically improving the efficiency of healthcare professionals, enabling healthcare systems to reduce the overall costs associated with primary care.”

The startup was founded nearly a decade ago, in 2010, and had only previously raised an angel round of $1.4M back in 2012 from an entrepreneur in Hamburg — but was profitable until the end of 2018. “We are now in investment mode,” Meinertz tells TechCrunch.

The growth opportunity its investors are spotting is both to expand to more markets, initially across Europe, but also to supplement over-stretched state healthcare services — with Zava gearing up to make a sales pitch to state healthcare services in the UK, France and Germany.

Its early profits have come from offering paid services either direct to patients, or via working with insurance companies or partnering with pharmacies. The next stage will be to open up a dual track in key markets such as the UK — supplementing direct paid consultations with winning business from the state funded National Health Service so the service is offered to their patients free-at-the-point-of-use.

Although at this stage Zava has not provided any details of state healthcare contracts it has won.

“We’re delighted that our latest investment will help fund the research required to enter this space in the UK, Germany and France,” says Meinertz of the Series A. “We feel passionately about the transformation of primary care and the Zava healthcare platform is primed to support it.”

“As Zava grows and scales in the UK, we are looking to work closely with the NHS to help it become more efficient. This will mean that we will be working with two distinct models in the UK, one where patients pay Zava for the services they receive from us, or, two, access Zava through the NHS and receive healthcare free of charge at the point of care,” he adds.

“Due to the different requirements of the healthcare systems in France and Germany, we are already exploring different routes to enter the statutory healthcare markets in these countries.

“In Germany, we will work with statutory and private insurance companies to provide healthcare to patients free at the point of care.”

Meinertz says the new funding will also go on expanding Zava’s medical and technology capabilities — to offer “many new services for patients across Europe”, with women’s health a near term focus.

“We will be launching dozens of new services in the UK and other markets during Q3 and Q4 of 2019. In particular, we are focussing on women’s health in the coming months, as well as new test-kits and mental health services,” he says, adding: “With our latest investment we are investigating routes to replicate Zava’s success in the current markets to new markets to accelerate growth. Our intention is to launch in two additional European markets by 2021.”

Since 2011, Zava has provided three million paid consultations across the six markets it operates in in Europe — with 1M those taking place in 2018 alone.

Every month it says almost 100,000 patients access its service from the UK, Germany, France, Austria, Switzerland and Ireland to seek advice, tests or treatment for a growing range of conditions.

On the surface, Zava’s approach looks considerably ‘lower tech’ than some of the other digital health startups also targeting a younger, tech-savvy generation of patients — such as London-based Babylon Health, which uses an AI chatbot as part of its telehealth mix.

But what it may lose in triaging scale and immediacy, by requiring patients spend time filling in a detailed questionnaire in order to access remote healthcare — vs offering a more dynamic chatbot-style Q&A with a patient — could represent a longer term, sustainable advantage if Zava can show this method reduces the risks of errors and misdiagnosis, especially as usage scales, and does indeed help to foster a stronger link between patient and app, as it claims.

“Patients fill in an online questionnaire giving details on their symptoms, past medical history and personal circumstances. This medical information is reviewed by one of our doctors who then decide the best course of action, whether this is prescribing medication, offering a diagnostic test, giving advice or requesting further information from the patient,” says Meinertz explaining Zava’s approach.

“The medical questionnaires have been developed by the clinical team and passed rigorous testing to ensure safe treatment to our patients.”

Patient dissatisfaction rates do appear to be an early challenge for ‘digital first’ healthcare services.

For example, an Ipsos Mori evaluation of Babylon Health’s rival GP at Hand service, published earlier this year, found high levels of patient churn — with one in four patients found to have left the practice since July 2017 vs an average across London during the same period of one in six.

How well Zava’s questionnaire review process scales will be key. (Trustpilot reviews of its current UK service skew overwhelmingly positive — but a full 3% of reviewers have left the lowest possible rating, with complaints including canceled orders, lost/delayed packages, privacy-related complaints and even the wrong strength medicine being sent.)

Currently the startup has an in-house clinical team comprised of more than 20 doctors, pharmacists and healthcare professionals. Though the plan with the new funding is to grow headcount.

“The majority of this team sits in our London head office but we offer flexibility for our staff, meaning that consultations can be offered by remote doctors. With this in mind, we have doctors based in France, Switzerland and Germany too who treat Zava patients,” adds Meinertz.

The typical Zava patient is a man or a woman aged between 20 and 40 who is resident in a major city.

“They are patients who are dissatisfied with their current healthcare options and they’re willing to try something new,” he says. “They want to avoid a face to face interaction or an inconvenient appointment, accessibility and reliability are the most important factors to them.”

While this tech-savvy target demographic may be willing to try an app over a traditional trip to the GP, they’re unlikely to stick around long if the underlying service doesn’t live up to their expectations. So there are major challenges for telehealth players like Zava — to make sure patients remain satisfied with the quality and reliability of the service as usage scales, and to find ways to foster a genuine sense of connection with remote doctors sitting in the equivalent of a call center. A shiny app wrapper on its own won’t go far.