As the COVID-19 pandemic reshaped our world, more consumers have begun shopping online in greater numbers and frequency. According to new data from IBM’s U.S. Retail Index, the pandemic has accelerated the shift away from physical stores to digital shopping by roughly 5 years. Department stores, as a result, are seeing significant declines. In the first quarter of 2020, department store sales and those from other “non-essential” retailers declined by 25%. This grew to a 75% decline in the second quarter.

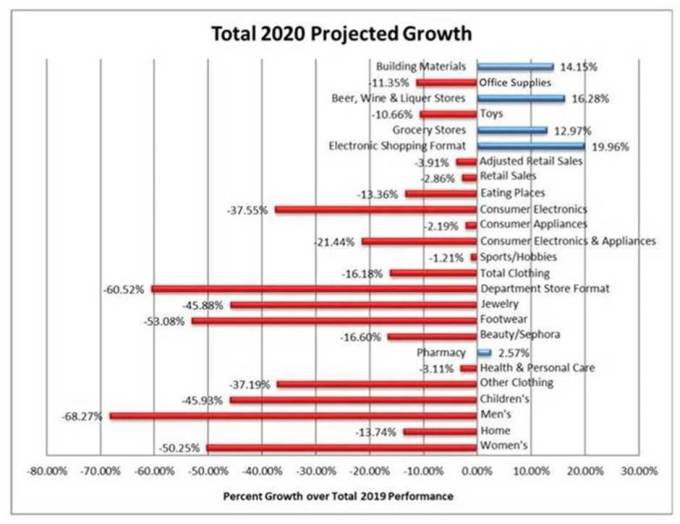

The report indicates that department stores are expected to decline by over 60% for the full year. Meanwhile, e-commerce is projected to grow by nearly 20% in 2020.

The pandemic has also helped refine which categories of goods consumers feel are essential, the study found. Clothing, for example, declined in importance as more consumers began working and schooling from home, as well as social distancing under government lockdowns. However, other categories including groceries, alcohol, and home improvement materials accelerated, by 12%, 16% and 14%, respectively.

Image Credits: IBM

The report suggests that department store retailers will need to more quickly pivot to omnichannel fulfillment capabilities in order to remain competitive in the new environment. Specifically, they will need to drive traffic to their stores through services like buy online, pickup in store (BOPIS) and will need to offer an expanded set of ship-from-store services.

Large retailers like Walmart and Target have embraced omnichannel fulfillment to their advantage. Both reported stellar earnings this month thanks to their earlier investments in e-commerce. In Walmart’s case, the pandemic helped drive e-commerce sales up 97% in its last quarter. Target set a sales record as its same-day fulfillment services grew 273% in the quarter. Both retailers have also invested in online grocery, with Walmart today offering grocery pickup and delivery services, the latter through partners. Target has also just now rolled out grocery pickup and runs delivery through Shipt.

Amazon, naturally, has also benefited from the shift to digital with its recent record quarterly profit and 40% sales growth.

The growth in e-commerce due to the pandemic has set a high bar for what’s now considered baseline growth. According to the Q2 2020 report from the U.S. Census Bureau, U.S. retail e-commerce reached $211.5 billion, up 31.8% year-over-year, in the quarter. E-commerce also accounted for 16.1% of total retail sales in Q2, up from 11.8% in the first quarter of 2020.

The questions that IBM’s report aims to answer is how much of this pandemic-fueled online spending is a temporary shift and to what extent is it impacting longer-term forecasts? The answer, at least in this estimate, is that this pandemic pushed the industry ahead by around five years. The shift away from physical stores was already underway, that is — but we’ve now jumped ahead in time as to where we would be if a health crisis had not occurred.

This is a similar trend to what other industries have seen as well, including things like streaming/cord cutting, gaming, and social video apps, and more.