Chicago has a long history of creating industry-leading companies and it doesn’t seem COVID-19 is slowing down the city. TechCrunch surveyed Chicago venture capitalists who remain optimistic despite the current crisis. COVID-19 could be good for Chicago, they told TechCrunch throughout their survey responses.

It’s clear from the responses below investors in Chicago are interested in startups in and out of the city. As explained in the responses, the partners and associates are happy to invest in worthwhile companies no matter where the company is located. That said, they see Chicago as a fantastic place to experience big city life with a much lower cost of living than what’s available in NYC, San Francisco or Seattle.

Here’s who we surveyed:

- Guy Turner, partner, Hyde Park Venture Partners

- Constance Freedman, founder and managing partner, Moderne Ventures

- Katie McClain, partner, Energize Ventures

- Bess Goodfellow, principal, Hyde Park Angels

- Rachel Stillman, associate, 7WireVentures

VCs are optimistic that COVID-19 will result in a win for Chicago

Guy Turner sees a possible outcome where Chicago and other cities in the region benefit from the COVID-19 fallout. He said, “In this sense, COVID could reaccelerate Chicago and other midcontinent cities’ startup communities with more availability of talent and cheaper operating costs. Might COVID result in tech flight to ex-urban or suburban communities around the midcontinent, or otherwise in third- and fourth-tier cities around the country?” He later notes this warning: “Related to the 2020 COVID recession, I would expect the availability of local capital for seed and post-seed stage financing to reduce somewhat.”

Constance Freedman of Moderne Ventures notes on COVID-19: “I think Chicago is poised to come out well. The city is affordable to begin with … like 50% more affordable than the West or East Coast hubs … Chicago has long been known for banking, real estate, health care and insurance. I think these sectors and others are poised to do well. The largest opportunity for us (and any major city) is how to close the education gap, which leads to closing the income gap and from there — the sky is the limit!”

Rachel Stillman of 7WireVentures is optimistic, too, in part saying, “We believe that Chicago will remain a technology hub and may actually stand to benefit from the shift to more remote work. As talent recruitment becomes democratized through location-agnostic roles, many of the functions that have been characterized by scarce talent pools (e.g., engineering, data science, product) will benefit from national recruitment capabilities. Additionally, strong candidates that prefer to remain in the Midwest were historically pushed to move to the coasts for career advancement.

Chicago VCs to continue regional and national focus

Nearly all the investors surveyed stressed their firms focus is not on just Chicago, but startups nationwide. None expect COVID-19 to change that mission.

Katie McClain of Energize Ventures said, “We expect to maintain a balance of investing in companies across geographies that are not limited to Silicon Valley. With many more firms going remote and relocating to areas outside of the West Coast since the start of the pandemic, we see a big opportunity for non-Bay Area companies to emerge. We’re excited about what that could mean for cities like Chicago and the Midwest in general.”

Guy Turner sees a similar outcome, noting, “We expect to maintain the same geographic focus after COVID, however, we are likely to be more open to teams and companies with a remote or partially remote working structure. In the past, we mostly avoided ‘virtual’ teams, but the last six months have proven at scale that companies can be innovative and productive with a largely remote culture.”

Guy Turner, partner at Hyde Park Venture Partners

How much is local investing a focus for you now? If you are investing remotely in general now, are you filtering for local founders?

We are geographically focused on the “midcontinent” — in which we include the Midwest, Toronto and Atlanta. We are indeed investing remotely right now, but are maintaining our geographic lens so that we sustain a focused sourcing, talent and co-investing network post-COVID. Early-stage investing is a very personal and network-driven business, so we want to be near and accessible to find and work with the best founders. Focusing on specific geographies has allowed us to do this and will again after COVID. Chicago represents about 40% of our activity historically and will likely continue to.

Long term, do you expect to be more or less locally focused?

We expect to maintain the same geographic focus after COVID, however, we are likely to be more open to teams and companies with a remote or partially remote working structure. In the past, we mostly avoided “virtual” teams, but the last six months have proven at scale that companies can be innovative and productive with a largely remote culture. Most “virtual” companies still have an HQ with several key leaders, and we seek companies that call a city in our geography HQ. The best way we’ve found to filter for the center of mass of a remote or virtually run company is to ask the question, “Where do you hold your holiday party or off-sites?” This usually coincides with the city where one or more founders live.

What do you expect to happen to the startup climate in Chicago longer term, with the shift to more remote work, possibly from more remote areas. Will it stay a tech hub? (Will there be tech hubs? What is a tech hub now?)

We remain optimistic that the decade of progress in Chicago’s march toward “tech hub” status will not be interrupted by COVID. Indeed, it was the higher unemployment and dropping rents of the financial crisis that helped spark the growth of the Chicago startup community, in what is otherwise a fairly traditional and conservative business community. One of the first companies we invested in paid $12/square foot/month in the Chicago Merchandise Mart in 2012. Depending how you count, that space reached $40 to $60/square foot in the 2019 peak.

In this sense, COVID could reaccelerate Chicago and other midcontinent cities’ startup communities with more availability of talent and cheaper operating costs. Might COVID result in tech flight to ex-urban or suburban communities around the midcontinent, or otherwise in third- and fourth-tier cities around the country? The new virtual work trend may enable more of that at the margin, but it’s hard to see it taking off at scale. In the long run, startups will still have to fly to sell their products or have employees fly in for HQ events post-COVID. That means most startups will want to have some center near a top 10 or top 20 airport. Young people (founders, tech talent, etc.) still want to date, experience nightlife and have fun with lots of other young people — i.e., city life.

Are there particular industry sectors that you expect to do uniquely well or poorly, locally?

Chicago has always been a logistics hub and is now becoming a logistics tech hub with companies like FourKites, Shipbob and Forager. COVID highlighted the fragility and importance of our food supply chains, making the role and potential of these companies increasingly visible. This will be good for Chicago and the broader Midwest.

In the short term, what challenges are facing Chicago’s startup scene?

Related to the 2020 COVID recession, I would expect the availability of local capital for seed and post-seed stage financing to reduce somewhat. While we were fortunate to raise our third fund late last year, some of our peer funds were still raising or planning to raise their next fund. A few are likely to come out smaller or to be significantly delayed in their next raise given the effects of COVID on most venture portfolios’ valuations and exit horizons. This means seed and post-seed rounds will probably be harder for local startups to raise for a few years. On the other hand, angel activity remains very strong given the rebound of public markets, and coastal funds continue to show strong interest and deployment in Series A and later in Chicago.

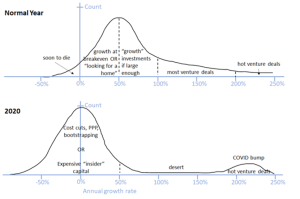

Likewise — as in every other geography — COVID has significantly slowed down the growth of most startups while aiding a small few. Chicago is no exception, though there are some restaurant tech startups (Tock, Chowly, etc.) and logistics startups (FourKites, Shipbob, Forager) that have come out on top. This is my mental model for what the startup opportunity set looks like during COVID versus normal times — but just as true anywhere else as here:

Image Credits: Guy Turner

Less related to COVID, Chicago has always been strong in sales talent but weaker on product and product-led growth talent. This is improving with each successive generation of successful startup outcomes like Grubhub, Cleversafe, Braintree, GoHealth, etc. But it’s a long journey.

Who are some founders (who you’ve invested in or otherwise) that are leaders in the community?

- Garry Cooper at Rheaply: Series A stage and has been very involved in social justice efforts locally.

- Amanda Lannert at Jellyvision: late stage and very active angel.

- Mike Evans at Fixer: co-founder of Grubhub and now runs a startup B-corp.

A lot of Bay Area founders and developers are looking to relocate. Why Chicago or even the Midwest?

The answer is pretty simple. The cost of living in Chicago — in particular housing — is about half or less that of the Bay Area/SF and NYC. If you go to a Minneapolis, Indianapolis or Cincinnati, you’re talking a quarter or a third. If you are starting a startup or a career in tech, that is a massively different paradigm under which to build a nest egg. You just can’t in most major coastal cities. Chicago is also a beautiful place with all the benefits of a top three U.S. city — culture, arts, career opportunities, education, accepting culture, etc.

Constance Freedman, founder and managing partner at Moderne Ventures

I think as a society we do not quite know how COVID is going to impact us all long term but what is becoming clear is that we are going to need to all figure out how to live with COVID for the foreseeable future, which could be many more months or, more likely, years.

What does that mean for the startup scene in Chicago? First, what does it mean for cities broadly? There will be a repositioning of sorts as workplaces everywhere evaluate what “work from home means” and where, when and how we go back to the office.

We are social people and we need social interaction so there will be a return of some kind — how and when is unclear.

Where do people want to live? Data is showing us that migration to the suburbs and second home markets are up — all those millennials who would never buy a home and move to the suburbs are buying homes and moving to the suburbs (or moving back in with their parents as the case may be); moves into the expensive first-tier cities are down. People who say, “Why am I living in a 300 square foot apartment with four roommates in NYC [or SF or insert equally crazy expensive city here] when I can’t even enjoy the city I am in?” are asking the right question. COVID has provided an opportunity for those who are still employed to reassess their quality of life and make changes.

I think this has big impact on the most expensive cities in the world and less impact on the secondary and tertiary markets. Short term, there is not much change but long term, as the Silicon Valley startups expand work-from-home, headquarters may also move.

World-class startups still need world-class feeders, so I don’t expect expansion to reach all that far, but perhaps density or proximity to work becomes less important for those who work there. This may give more cities a change to rise, including Chicago.

So what does this mean for Chicago startup ecosystem? I think Chicago is poised to come out well. The city is affordable to begin with … like 50% more affordable than the West or East Coast hubs. If I live in Chicago I can afford space, I can enjoy my city and I have good transportation if I want to bail out of the city and move to the suburbs. Chicago has a strong ecosystem of universities and capital that can sustain it and may become more appealing to those (tech people and investors) who moved out to go to the coasts in the first place and now realize they don’t need to be there. As people migrate to live where they really want to live, with the lifestyle they want to have, near family they want to be with, they begin to look for more local opportunities and that may bring some great talent back to Chicago and other markets outside of the coasts.

Chicago has long been known for banking, real estate, health care and insurance. I think these sectors and others are poised to do well. The largest opportunity for us (and any major city) is how to close the education gap, which leads to closing the income gap and from there — the sky is the limit!

Katie McClain, partner at Energize Ventures

How much is local investing a focus for you now? If you are investing remotely in general now, are you filtering for local founders?

When we look at investments, we focus on diversifying our portfolio — and that includes diversity across geographies. While we don’t necessarily have a filter for local founders, we are intentional about making sure about half of our investments are in companies outside of the Bay Area. Our portfolio includes startups based in Chicago, Austin, Boston, New Jersey and Switzerland, just to name a few. For us, it’s important to be closer to the customer – and we love it when we can find them close to our hometown. We’ve actually just recently invested in a Chicago-based company that we’re very excited to announce soon, so stay tuned!

Long term, do you expect to be more or less locally focused?

We expect to maintain a balance of investing in companies across geographies that are not limited to Silicon Valley. With many more firms going remote and relocating to areas outside of the West Coast since the start of the pandemic, we see a big opportunity for non-Bay Area companies to emerge. We’re excited about what that could mean for cities like Chicago and the Midwest in general.

From that, what do you expect to happen to the startup climate in Chicago longer term, with the shift to more remote work, possibly from more remote areas. Will it stay a tech hub? (Will there be tech hubs? What is a tech hub now?)

We believe the shift away from traditional tech hubs like New York, Boston and San Francisco presents a great opportunity for Chicago as people are discovering they can be efficient, innovative and collaborative in other pockets of the world. This could play out positively for our city in a number of ways, from creating jobs to enabling new opportunities for investors to back Chicago-based companies. It’s important to note that we believe certain sectors with centers of gravity in Chicago — like energy, industrials and manufacturing – are here to stay. However, how far that reach might extend beyond the Loop and into the broader ecosystem is still a work in progress.

Are there particular industry sectors that you expect to do uniquely well or poorly, locally?

There are several industries that have a particularly strong presence in Chicago — namely finance, renewable energy, manufacturing and industry (it’s no coincidence that Energize plays in a bit of each of these arenas!). On the finance side, I think it is easier for that sector to transition to a more remote, distributed environment. For more asset-based industries like energy, manufacturing and commodities, we see this as more of a challenge. However, the highly distributed nature of our new world is accelerating adoption of digital technologies in these sectors, and this is what we’re most excited about!

For example, a company like Beekeeper, which provides a digital communication and collaboration tool for frontline workers, presents a compelling value proposition for energy and industrial businesses in Chicago that have had to entirely alter on-the-ground operations due to COVID-19. Another example of this is a drone software provider: DroneDeploy has seen five times as many flights among its energy customers this year given the spike in demand for remote services. There is a strong presence of “essential” industries in Chicago that we believe are here to stay, but how they operate will be different — and that is where technologies like these can play an important role in shaping the future of work and driving innovation.

In the short term, what challenges are facing Chicago’s startup scene?

Not having as strong of a reputation for its startup scene as cities on the coasts, Chicago can sometimes be overlooked by big-name investors who tend to stay local. In addition, now that many coastal VCs are retrenching, early-stage Chicago companies that would typically rely on them will need to find other sources of capital to fill the gap. That said, it’s more important than ever to raise awareness about rich and diverse startup ecosystem we’ve developed here.

Who are some founders (who you’ve invested in or otherwise) that are leaders in the community?

We haven’t invested of any of these founders, but if you would like intros we could possibly arrange: Jennifer Holmgren (LanzaTech), Matt Silver (Forager), Michael Polsky, the leading local energy entrepreneur who founded Invenergy (our anchor investor) and chairs Energize’s investment committee.

A lot of Bay Area founders and developers are looking to relocate. Why Chicago?

Chicago offers access to a high-quality, diverse pool of corporates and potential customers, particularly in industries like energy, critical infrastructure and manufacturing that are beginning to adopt emerging technologies at an accelerated pace. You also can’t beat those Midwestern values — stereotypes aside, we’re proud to be among neighbors who bring a grounded, get-it-done mentality! We believe Chicago is the perfect nexus of talent, grit and opportunity upheld by a committed community of investors and operators.

Any other thoughts you want to share with TechCrunch readers?

Energize is very bullish about the digital transformation we see happening right now. Companies in established industries are adopting technologies faster than ever before, and that’s not constrained to the West Coast. The core of our thesis is “accelerating digital innovation in energy and heavy industry,” and we’re seeing that play out across the globe. Innovation at scale is happening right here in Chicago, and we’re excited to be a part of that ecosystem. Lastly: If you’re building a company that provides software or business model innovation to help propel this exciting transformation, we’d love to hear from you!

Bess Goodfellow, principle at Hyde Park Angels

How much is local investing a focus for you now? If you are investing remotely in general now, are you filtering for local founders?

HPA focuses on the Midwest, so the pandemic hasn’t altered that focus; however, we certainly have engaged remotely with entrepreneurs more than before. We’ve completed 13 new deals this year already. Three deals were announced the past few weeks (Chowbus, Cohesion and Dispatch) and another new deal will be announced next week.

Long term, do you expect to be more or less locally focused?

The same.

What do you expect to happen to the startup climate in Chicago longer term, with the shift to more remote work, possibly from more remote areas. Will it stay a tech hub?

Absolutely. The macro trends are favoring many of the tech companies helping to accelerate growth, which is essential for the health of the tech community. We are optimistic that the companies that are hitting headwinds will be supported by those growing rapidly. Thankfully, we are seeing that already in our portfolio.

Are there particular industry sectors that you expect to do uniquely well or poorly, locally?

Digital health, direct-to-consumer and e-commerce are doing really well in Chicago.

Any other thoughts you want to share with TechCrunch readers?

We’ve seen recent success with Sprout Social and GoHealth going public. Other Chicago-affiliated companies like Tempus, Livongo and FourKites are emerging as clear industry leaders in their respective categories. We expect to see more of our portfolio and those throughout Chicago continue to do what hardworking Chicagoans do, and fight through this pandemic to emerge even stronger!

Rachel Stillman, associate at 7WireVentures

How much is local investing a focus for you now? If you are investing remotely in general now, are you filtering for local founders?

We have been and remain supporters of the Chicago community and continuously advise and meet with entrepreneurs in this ecosystem. With that said, we continue to have a national geographic focus as we are interested in growing great founders and teams first and foremost.

Long term, do you expect to be more or less locally focused?

Our focus long term with regard to local investments will remain the same, and we will continue to be actively engaged and supportive of the Chicago early-stage health care and technology ecosystem. We acknowledge that travel restrictions and adherence to social distancing guidelines may inhibit our ability to conduct onsite visits with founders outside of our local market, but we will continue to be creative about conducting remote diligence of management teams.

From that, what do you expect to happen to the startup climate in Chicago longer term, with the shift to more remote work, possibly from more remote areas. Will it stay a tech hub? (Will there be tech hubs? What is a tech hub now?)

We believe that Chicago will remain a technology hub and may actually stand to benefit from the shift to more remote work. As talent recruitment becomes democratized through location-agnostic roles, many of the functions that have been characterized by scarce talent pools (e.g., engineering, data science, product) will benefit from national recruitment capabilities. Additionally, strong candidates that prefer to remain in the Midwest were historically pushed to move to the coasts for career advancement. Decentralized (and remote) work will now allow for more investment in Chicago talent, both in recruitment efforts and capital investments. Chicago will continue to have strong universities and innovation ecosystem drivers — 1871, Matter Health, the Polsky Center for Entrepreneurship — that will produce and attract exciting technology companies. Entrepreneurs will still seek a sense of community and a place to ideate and engage with like-minded creators, and Chicago will continue to fulfill that need within the technology ecosystem.

Are there particular industry sectors that you expect to do uniquely well or poorly, locally?

We have seen a rise in the quantity and growth of companies across digital health and health care IT. Exits and liquidity events of successful digital health companies such as Livongo will drive a new wave and generation of technology founders equipped with capital and domain expertise. Ecosystem aggregators and incubators such as Matter Health will continue to support early growth from ideation to creation of healthcare solutions. Therefore, we remain bullish on the local healthcare ecosystem and believe it has yet to reach its full potential.

In the short term, what challenges are facing Chicago’s startup scene?

Historically, Chicago has received a lower amount of venture capital dollars relative to competing major metropolitan cities. With less initial funding, founders in Chicago may focus more on pragmatically growing companies with financially sound strategies (versus the “growth at all cost” mentality of the coasts). Additionally, less capital makes it harder to recruit talent in some cases, as companies located in coastal cities may have the financial resources to offer very attractive packages, particularly to technologists, who then will leave the Chicago market. Given the workforce changes driven by COVID-19, we have started to see a shift in companies’ willingness to recruit from remotely located talent pools. Companies located in coastal markets with deeper capital pools will be able to afford to pay a higher premium for quality talent in Chicago, enabling these top talent recruits to remain in the city. Over the past two years, Chicago has attracted an increased amount of venture dollars and incited the development of new venture firms and additional funds, with venture capital deployed to Chicago companies exceeding $2 billion in 2019. With Chicago reported to be one of the strongest cities for venture capital returns, we believe that firms seeking opportunities to maximize ROI will continue to invest in Chicago and further fuel the growth we’ve observed in the city.

Who are some founders (who you’ve invested in or otherwise) that are leaders in the community?

There are several prominent founders across the Chicago startup community; we have highlighted two across our portfolio but note that these alone certainly do not capture the full market of founders across this highly impressive ecosystem.

Across 7wireVentures investments, Stephen Smith, founder and CEO of NOCD, is a leader we are incredibly proud to have within our portfolio. Faced with the challenges of receiving appropriate obsessive compulsive disorder (“OCD”) treatment himself, Stephen was inspired to found NOCD, a specialty telehealth platform that identifies and manages people with OCD by delivering personalized therapy. In addition to servicing people with NOCD, the company has scaled to create high-profile local jobs in the Chicago market and the Midwest.

Additionally, we are incredibly proud of two of our co-founders, Dave Jacobs and David Greenberg, who built and scaled Homethrive alongside our team through the 7wireVentures hatch model. Homethrive is a tech-enabled platform supporting aging-in place by providing seniors and their caregivers personalized insight, advice and validated resources for key nonclinical services. The company has created over 40+ jobs in Chicago and supported hundreds of family caregivers across Chicago, the Midwest, and the country. The “Dave’s” (as they are referred to at 7wire) have been pivotal in the ideation, development and successful growth of the company.

I would also be remiss not to mention my long-time business partner, Glen Tullman, executive chairman and founder of Livongo. Despite the success we have had over the years exiting multiple companies, Glen and I both have committed to remain in Chicago, a city and technology ecosystem we both believe in. Glen has committed his career to improving the safety, empathy and efficiency of the U.S. health care system. His vision and efforts to bring together health and technology were pivotal in scaling Livongo to what is now a $13 billion+ company and as a result, created hundreds of jobs across the Chicago health care and technology ecosystem.

A lot of Bay Area founders and developers are looking to relocate. Why Chicago?

While other major cities may offer a concentrated hub of technology experts, Chicago uniquely embodies the culture of strong “Midwestern work ethics.” The city attracts and grows talent pools influenced by Midwestern values and humility, with an unwavering willingness to work thoughtfully. As a result, the Chicago technology community is tightknit but still welcoming to outsiders, and deeply values collaboration and shared ideation. For founders and developers looking to relocate, Chicago offers a community of bright-minded individuals at a cost of living discount relative to its large metropolitan city companions.

In addition to the strong culture, Chicago offers a unique talent pool characterized by a combination of corporate-bred individuals bringing institutional knowledge, and a growing pipeline of employees raised in startups. Illinois is home to 66 of the Fortune 500 companies (the number four state in the U.S.), while a new wave of successful Chicago-based technology companies have complemented the candidate pool with technology talent from the likes of Salesforce, Groupon, Livongo, Grubhub and Braintree.

Finally, founders located in Chicago stand to benefit from the proximity and local access to their target customers, many of which are not residing in the coastal cities but here in the Midwest. In the early stages of building a company, it is fundamental to intimately understand and know the problems of your customer. There is no better strategy to learn and share the values of your target clients than to live among them in the Midwest.